EVENT

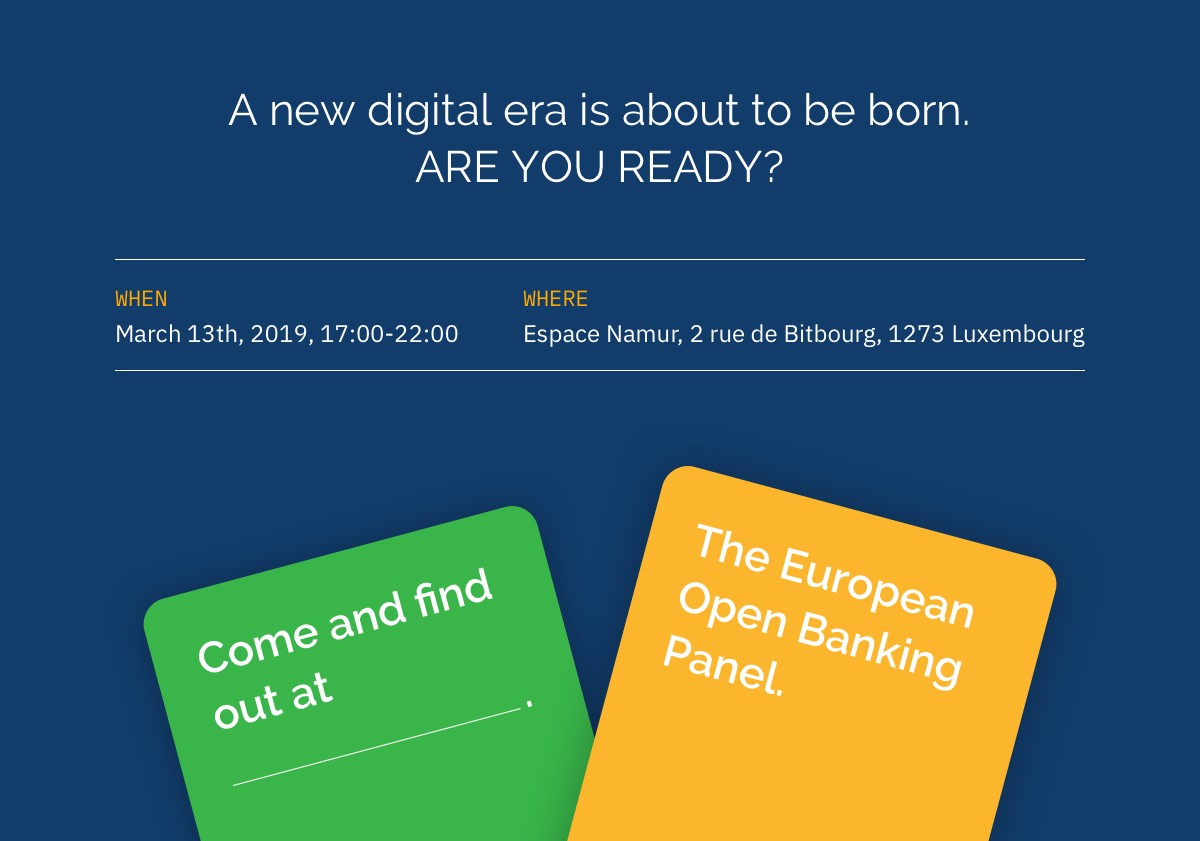

THE EUROPEAN OPEN BANKING PANEL 13th of March 2019 LUXEMBOURG

LUXHUB, the European Open Banking API Platform service provider will organise the 1st European Banking Panel taking place on the 13th of March 2019 at Espace Namur in Luxembourg.

February 26, 2019

LUXHUB, the European Open Banking API Platform service provider will organise the 1st European Banking Panel taking place on the 13th of March 2019 at Espace Namur in Luxembourg.

LUXHUB, the European Open Banking API Platform service provider will organise the 1st European Banking Panel taking place on the 13th of March 2019 at Espace Namur in Luxembourg.

We’re reaching the final act of the PSD2 timeline. Open Banking will change the mind and culture and most important increase the competition of payments in Europe with an impressive speed.

The Regulatory Technical Standards of the second Payment Services Directive specifies that on March 14, 2019 doors must open by letting interested regulated third parties explore the open banking ecosystem and start developing applications around it. Financial Institutions should open a sandbox environment ready to onboard third parties where testing can be done without exposing any sensitive information.

The First European Open Banking Panel has as purpose the gathering of specialists and experts that will share, discuss and develop the massive amount of information that all the financial institutions need to acknowledge during the next months.

LUXHUB is putting on the same roof key Open Banking experts for an open discussion regarding the new digital future on the 13th of March 2019 at Espace Namur Luxembourg, starting 17:00.

Among speakers we quote:

Nils Jung / Managing Partner Innopay (Germany)

John Broxis / Managing Partner PRETA, (EBA Clearing – Paris)

Gijs Boudewijn / Chairman Payment Systems Commitee at European Banking Federation & Member of the API Evaluation Group at European Commission

Ralf Ohlhausen / Business Development Director at PPRO Financial Ltd & Member of the API Evaluation Group at European Commission

Jacques Pütz / CEO LUXHUB

For registration and more info please visit www.openbanking.lu

[toggle title =”About LUXHUB“] LUXHUB was born by combining an extensive banking knowledge with the agility of a start-up. Jacques Pütz, LUXHUB’s CEO says: “We imagined a company that gathers credibility, know-how and the power to sustain all the actors of the new digital era”.

Created by 4 major retail banks, LUXHUB aims at providing an innovative answer to the upcoming PSD2 European Directive and therefore at offering new solutions and services to the many actors of the financial sector.

LUXHUB is taking on this role of smoothing out the operational integration of the financial institutions with the main mission of acting as a facilitator for Fintechs, notably helping them connect to banks.[/toggle]